Results for the first half of 2023: 12.4% increase in NAV

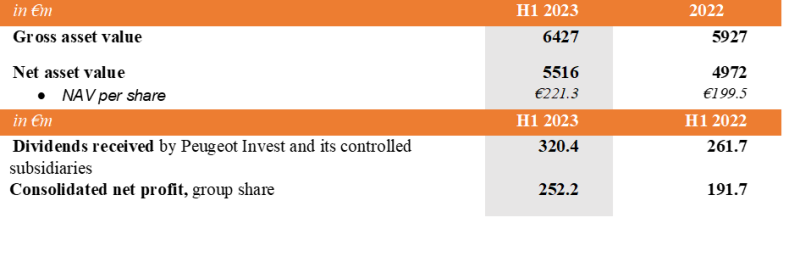

• NAV of €221.3 per share, i.e. a performance of 12.4% cum dividend

• Consolidated net profit, group share, of €252 million, up compared to the first half

of 2022

• Continued asset rotation with €262 million of disposals and €199 million invested before the acquisition of a stake in Rothschild & Co

• High exit multiples, demonstrating value creation in investments

Commenting on these results, Robert Peugeot, Chairman of Peugeot Invest, said,

"Peugeot Invest's results were delivered in a changing and uncertain economic environment, marked by geopolitical instability and the rapid rise in inflation and interest rates. I applaud the excellent results achieved by Stellantis, faced with the challenges of the automotive sector. By investing in a variety of sectors and markets with an ever greater underlying exposure in the United States, we have been able to mitigate the effects of this global economic turbulence over the last few years. Finally, I am delighted with the success of the takeover bid which enables us to hold 5.1% of the capital of Rothschild & Co."

Bertrand Finet, Chief Executive Officer of Peugeot Invest, added,

"Peugeot Invest performed well in the first half of the year, in a complex economic environment. The Group has made some fine value-creating disposals, demonstrating the relevance of the choices it has made, as well as some promising new investments. "

The Board of Directors, chaired by Robert Peugeot, met on 13 September 2023 to approve the financial statements for the first half of 2023.

NAV: A STRONG PERFORMANCE IN A CHANGING ENVIRONMENT

As at 30 June 2023, net asset value (NAV) per share was €221.3 million, as opposed to €199.5 million at 31 December 2022. This represents a return (cum dividend) of + 12.4% in the first half of 2023, outperforming the financial markets.

Over the course of the half-year, the listed shareholdings performed well and above the capital markets. The valuation of co-investments was driven by Polyplus's value creation, while the figure for the investment funds was stable, having been adjusted for calls and redemptions over the course of the half-year.

In an unsteady macroeconomic and geopolitical environment, which was notably marked by a record acceleration in inflation and rising interest rates, the real estate sector (11% of gross asset value at the end of 2022) was hit particularly hard, with upward pressure on capitalisation rates and the impact of remote working on the use and attractiveness of office locations. In this uncertain environment, the valuation of the majority of our real estate assets was adjusted downwards.

AN INCREASE IN FINANCIAL INCOME, DRIVEN BY DIVIDENDS RECEIVED

Consolidated net profit, group share, was €252.2 million in the first half of 2023, compared to €191.7 million as at 30 June 2022. This increase mainly reflected the increase in dividends received by Peugeot Invest and its controlled subsidiaries, which amounted to €320.4 million, compared to €261.7 million in the first half of 2022.

PEUGEOT 1810

Stellantis had a particularly strong start to the year, with a 12% increase in revenue compared to the first half of 2022, mainly due to its increased sales volumes, which reached 3.33 million units, representing a 10% increase. With the acquisition of 33% of Symbio and the opening of its first production site for ACC (Advanced Carbon Composite) batteries in Hauts-de-France, Stellantis continued to invest in low-carbon mobility to ensure the long-term sustainability of its business.

For Forvia, the first half of 2023 was marked by substantial growth in revenue, which reached €13.6 billion, representing a 21% increase. This performance was boosted in particular by the recovery in automotive sales volumes in Europe and Asia. On the back of these promising results, management has raised its financial targets for this year.

SOLID, DIVERSIFIED INVESTMENTS CREATING LONG-TERM VALUE

Peugeot Invest continued to rotate its assets and take disposal opportunities centred on substantial value creation, carried out at valuations higher than those posted in the previous half-year. Gains on disposals and distributions amounted to €262 million in the first half of 2023 (compared to €291 million in the first half of 2022).

These enabled €199 million of new investments to be financed in the first half of 2023.

1. Shareholdings

Alongside Concordia and other long-term investors, Peugeot Invest undertook to invest up to €152 million in Rothschild & Co. On 12 September, the AMF announced the successful completion of the offer enabling the implementation of the squeeze-out. Peugeot Invest now holds 5.1% of Rothschild & Co's capital and will be represented on the company's Supervisory Board following this transaction.

The reorganisation of the capital structure of the LISI group enabled Peugeot Invest to sell part of its direct shareholding, which was acquired 20 years ago, for €58 million, representing a multiple of 6.9x (10% IRR). Peugeot Invest has retained a direct shareholding of 14.4% in LISI's share capital and continues to play its role as a long-term shareholder by taking part in the group's governance.

Peugeot Invest also sold its shareholding in Tikehau Capital Advisors (TCA), the main shareholder of Tikehau Capital, after seven years alongside the founders, generating a performance of 2x the invested amount. Peugeot Invest will continue to partner with Tikehau Capital, including as an investor in some of its funds.

Peugeot Invest also sold the FFP-Les Grésillons warehouse, which had been rented to Gefco for 23 years, for €37 million, i.e. for 40% more than its appraisal value at the end of 2021, benefitting from market conditions that were still very favourable. This disposal generated an IRR of 13% over 23 years.

2. Co-investments

Peugeot Invest invested €18 million in Doctrine, an innovative business that is transforming legal research. This investment, which was made alongside Summit, one of the investment funds in its portfolio, was driven by the company's growth potential and Peugeot Invest's commitment to supporting promising technology companies.

Peugeot Invest reinvested €20 million in Ynsect, a business that produces insects for animal feed. This investment supported the completion of the company's manufacturing plant.

Continuing its partnership with JAB Holding, Peugeot Invest reinvested $15 million in Prêt Panera preferred shares to support the development of this food-service platform in North America. Part of Peugeot Invest's investment in JAB's pet insurance platform was also called.

Furthermore, Peugeot Invest invested €20 million in Gruppo Florence, alongside VAM and Permira, exposing the company to the luxury ready-to-wear industry through its contractors in Italy. Alongside Tikehau Capital, it also invested €12.5 million in Hôtel California, a 4-star hotel in central Paris which will be restructured.

3. Investment funds

In the first half of 2023, Peugeot Invest committed a total of €124 million in 11 new investment funds. These committments were mainly made to management companies managing funds in which Peugeot Invest has already invested in the past, continuing the sector and geographical diversification of its investments and its continued pursuit of new growth opportunities.

LIMITED DEBT

As at 30 June 2023, net debt amounted to €862 million, compared to €885 million at 31 December 2022. This amount includes the €152 million set aside for the investment in Rothschild & Co, disbursed in the second half of the year. The loan-to-value ratio remained limited, at 14%, and decreased over the half-year. All of the drawn debt was fixed-rate debt.

Undrawn credit facilities amounted to €898 million as at 30 June 2023.

POST CLOSING EVENTS

After the end of the reporting period, there were several noteworthy developments in Peugeot Invest's portfolio.

First of all, our investment in Polyplus, in the field of gene therapy, alongside our partner, ArchiMed, specialising in healthcare, was sold to the Sartorius group in July, as the group recognised the company's strategic value. Peugeot Invest received €70 million in this transaction, i.e. a net multiple of 3.8x and an IRR of 62%.

TotalEnergies acquired all of the Total Eren group, following the strategic agreement entered into by the two companies in 2017. After spending 8 years alongside a talented team to develop a world leader in renewable energy, Peugeot Invest received €64 million in proceeds from the disposal, i.e. a multiple of 2.3x and an IRR of 13%.

Lastly, Peugeot Invest recently made a co-investment of €25 million in Nomios, a European leader (with 50% of its operations in France) in the field of cybersecurity and IT network services. This transaction took place alongside our partner, Keensight, which has a strong track record in this sector.