A very active year, with NAV up 32.2%

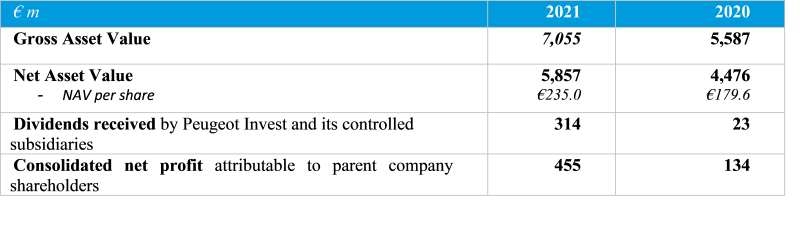

Gross Asset Value hit a new all-time high of €7 billion, and NAV per share reached a record €235, representing a return of 32.2% including dividends

2021 was a very active year, with €726 million invested and €605 million of disposals

Dividend up 13 % to €2.65 per share

Robert Peugeot, Chairman of the Board of Directors, and Bertrand Finet, CEO, said:

Last year was a turning point in Peugeot Invest's history with the creation of Stellantis, whose 2021 results clearly show the benefit of merging its two constituent groups, along with management's high-quality execution.

Our NAV rose by 32.2%, reaching its highest level ever, illustrating the quality of the companies selected in an economic recovery environment.

This year was particularly active for Peugeot Invest, with €726 million invested in various promising sectors, to prepare tomorrow's value creation, which was mainly financed by €605 million in disposals.

In addition, 2021 was the second year in which we implemented our ESG roadmap. Governance and climate transition are central concerns at Peugeot Invest, because of our position as a responsible shareholder.

Unfortunately, 2022 has begun with the war in Ukraine and all the human, political and economic uncertainty that comes with it. Peugeot Invest's assets currently have limited exposure to Russia and Ukraine. However, it is not yet clear how the war will affect the global economy in the short and medium term.

In this volatile environment, we will continue to implement our long-term investment strategy, while paying particularly close attention to the business models of target companies.

Nav per share: €235, representing a return of 32.2% in 2021

At 31 December 2021, net asset value (NAV) per share was €235.0 as opposed to €179.6 at 31 December 2020, representing a return of 32.2% including dividends for 2021, higher than that of the main European indices.

The vast majority of Peugeot Invest's assets had a very good 2021, showing their quality, solid foundations and resilience to crises. Unlisted investments, particularly private equity funds and co-investments, performed particularly well.

Resumption of dividend payments by investees contributing to the increase in consolidated net profit.

Consolidated net profit attributable to parent company shareholders amounted to €455 million in 2021, as opposed to €134 million in 2020. That increase was mainly due to the resumption of dividend payments by our investees (€140 million versus €23 million in 2020), the distribution of Faurecia shares by Stellantis (€173 million), and €326 million of distributions and increases in the value of private equity funds and co-investments (versus €203 million in 2020).

2021 highlights

Peugeot 1810

Peugeot 1810 consists of Peugeot Invest's stakes in Stellantis and Faurecia, its long-standing investments in the automotive sector.

The Stellantis group, resulting from the merger between Peugeot SA and Fiat Chrysler Automobiles NV, came into being on 16 January 2021. Stellantis has large market shares in Europe and the Americas, and is benefiting from the excellent fit between the two merged groups in terms of technologies and product ranges.

It reported revenue of €152 billion in 2021, up 14% year-on-year, along with record recurring operating margin of 11.8%, driven by €3.2 billion of merger synergies.

In accordance with the agreements signed in relation to the merger between PSA Group and Fiat Chrysler Automobiles, Stellantis distributed its Faurecia shares to its shareholders in March 2021. As a result, Peugeot 1810 is now one of Faurecia's core shareholders.

In the summer of 2021, Faurecia announced the acquisition of Hella. This transformative transaction has made Faurecia the world's seventh-largest auto parts supplier, and has given it critical mass in the electronics segment. After the acquisition of additional shares and the completion of Hella’s acquisition, Peugeot 1810 holds a 3.1% stake in Faurecia.

Post merger, Faurecia decided to change its name and became Forvia in February 2022.

Shareholdings

Peugeot Invest acquires minority equity stakes in companies, playing an active role on boards of directors and board committees and providing its expertise with a long-term perspective.

Peugeot Invest continued to apply its strategy in 2021, seeking target companies whose businesses are being driven by secular growth trends.

In line with this strategy, Peugeot Invest invested $306 million in International SOS in February 2021. International SOS was founded in Singapore in 1985, and provides preventive healthcare, security, healthcare treatment and emergency response services to international companies and government organisations. It generated revenue of $1.5 billion in its financial year ended 30 June 2021.

Peugeot Invest increased its exposure to real estate by acquiring a 5% stake in SIGNA Development for €75 million. This company's strategy consists of developing premium real-estate projects (residential, office and retail) in German-speaking Europe. Its portfolio consists of around 50 projects currently in progress, the final value of which should be around €8 billion.

These investments were funded in particular by some significant disposals.

After selling part of its stake in Safran in November 2020 through a forward sale agreement that was settled in March 2021, Peugeot Invest continued its divestment and in the first half of 2021 sold €208 million of shares, representing most of its remaining stake and taking the total amount of Safran shares sold since 2018 to €340 million, with an IRR of 13.7%.

Peugeot Invest sold all of its 10.1% stake in IDI for €27.2 million, representing a return of 2.3 times its investment.

Co-investments

Peugeot Invest works with investment funds that specialise in particular sectors and geographical regions, and makes equity investments alongside them.

In 2021, Peugeot Invest made co-investments totalling €230 million, mostly alongside existing partners, and it made three new co-investments in future-facing industries.

The partnership formed with ArchiMed in 2018, aimed at increasing Peugeot Invest's exposure to the healthcare sector, resulted in significant investment activity in 2021, with almost €105 million invested in companies acquired by MED Platform I, including:

Prollenium, a Canadian medical aesthetics company based in Toronto

Suanfarma, a Spanish company that develops, distributes and manufactures pharmaceutical and neutraceutical active ingredients

Carso, a French company specialising in laboratory testing and analysis, and joint leader of the French testing market

Stragen, a Swiss company specialising in complex generic medicines

The partnership with JAB continued, with new investments in that group's companies following commitments made in previous years. The JAB Holding preferred shares that Peugeot Invest subscribed in July 2018 were redeemed, and it also received distributions of JDE and Krispy Kreme shares.

Peugeot Invest expanded its network of partners in Asia and made a commitment to the Singapore-based Venturi co-investment platform. The platform specialises in investing in high-growth companies in India and Southeast Asia, focusing on consumer themes. Peugeot Invest will act as sponsor and has committed to invest $25 million. Alongside Venturi, Peugeot Invest has already invested in LivSpace, an Indian start-up that is a leading one-stop-shop for interiors.

Peugeot Invest also continued to support the growth of Lineage, the world leader in cold chain logistics, by contributing $25 million to its most recent capital increase.

Peugeot Invest additionally made a new €10 million co-investment in French company Ynsect, a leading player in farming and processing insects to produce ingredients used as alternatives to traditional animal proteins.

Peugeot Invest also invested $15 million alongside Crescent Point in Maikailai, a fast-growing Chinese company that sells beauty, personal care and home care products direct to consumers in China, particularly via livestreaming platforms.

As regards real estate, 2021 was also a busy year for our US partner ELV, which sold five projects for a total of $69.3 million – generating IRRs of between 8% and 31% – and committed $10 million to six new projects.

On 16 December 2021, PAI Partners announced the disposal of Asmodee to Swedish video game specialist Embracer. Peugeot Invest had invested a total of €21.5 million in Asmodee in 2018. The transaction was completed on 8 March 2022, and Peugeot Invest's proceeds represented 2.7x of its initial investment.

Investment funds

Peugeot Invest makes commitments to private-equity and real-estate funds to make its portfolio more diverse in geographical and sector terms, to seize new opportunities to create value.

In 2021, Peugeot Invest made 14 new commitments to investment funds totalling €204 million: €104 million to buyout (LBO) funds, €35 million to growth technology funds, €55 million to growth funds and €10 million to a real-estate fund.

In 2021, calls for funds amounted to €149 million. Distributions were more than double the level seen in previous years, totalling €94 million in 2021.

Debt

At 31 December 2021, Peugeot Invest's net debt amounted to €1,198 million as opposed to €1,023 million at 31 December 2020. Its loan-to-value ratio was 17% at 31 December 2021, lower than at the start of the year. Unused credit facilities amounted to €654 million at 31 December 2021.

Dividend

Peugeot Invest's distribution policy aims to ensure a consistent and rising dividend. Accordingly, and taking into account the company's strong 2021 results, Peugeot Invest will propose a dividend of €2.65 per share, representing an total amount of €66 million and a year-on-year increase of 13%, to shareholders in the 12 May 2022 Annual General Meeting.

Post-closing events

In February and March 2022, Peugeot Invest completed the sale of part of its Keurig Dr Pepper stake for $106 million. The average selling price was $38.1 per share, i.e. 1.72x the reference price at the time of the July 2018 merger.

Peugeot Invest has made a commitment to invest $100 million alongside JAB Holding to support its growth strategy in the consumer goods and services sector. The committed funds will mainly be invested in pet-related companies (including pet insurance providers) and in other sectors in which JAB's teams have in-depth knowledge.

Peugeot Invest has invested €15 million in Schwind, a German producer of ophthalmic lasers for refractive surgery, alongside Adagia, in whose funds Peugeot Invest also invests.

Following the publication of a book implicating Orpea and the public debate it is generating concerning the care of the dependent elderly, the Board of Directors of Orpea, of which Peugeot Invest is a member, undertook to fully investigate the matter. It has commissioned two consulting firms to conduct an independent assessment of these allegations and terminated the mandate of the CEO. As a result of this affair, Orpea's share price on 21 March 2022 has fallen by 59% since the beginning of the year.

The war in Ukraine is a tragedy that is creating concern all over the world. Neither Ukraine nor Russia are significant markets for our investees. The consequences of the war are still very difficult to assess and the resulting uncertainty has pushed down the share prices of Peugeot Invest's listed assets.