A diversified business model, resilient assets and a strong balance sheet

• Gross Asset Value of €5.9 billion and NAV per share of €199.50, down 14%

o Record Stellantis results in 2022 not reflected in its 20% share-price decline

o Return on Investments of -10%, in line with the market

• Dynamic asset management with €532 million in disposals creating value and investments in growth themes totalling €329 million

• Net debt down €261 million, at 16% of Gross Asset Value; €847 million in available credit facilities

• Increase in dividends received to €286 million, supported by the success of Stellantis

• Proposed dividend of €2.85 an increase of 7.5%

Robert Peugeot, Chairman of the Peugeot Invest Board:

"Peugeot Invest has managed to successfully navigate the last three years, marked by the Covid-19 pandemic, the war in Ukraine and the difficulties of the technology sector. I would like to highlight the exceptional performance of Stellantis, just two years after its launch, a performance that has not yet translated into a share price adjustment. With significant resources at our disposal, we continue to invest in the long term, with an in-depth ESG approach both in our internal practices and in our investments."

Bertrand Finet, Chief Executive Officer of Peugeot Invest:

"In 2022, Peugeot Invest teams pursued a selective investment strategy, committing €329 million to companies benefiting from structural growth trends in the global economy. At the same time, we sold €532 million in assets to release value and strengthen our balance sheet. This reduced our net debt and ensured a very reasonable LTV ratio, at 16%. As a result, we started 2023 with a strong balance sheet and are ready to seize opportunities."

The Board of Directors, meeting on 21 March 2023 under the chairmanship of Robert Peugeot, approved the financial statements for 2022.

NAV: €4,972 MILLION, OR €199.50 PER SHARE

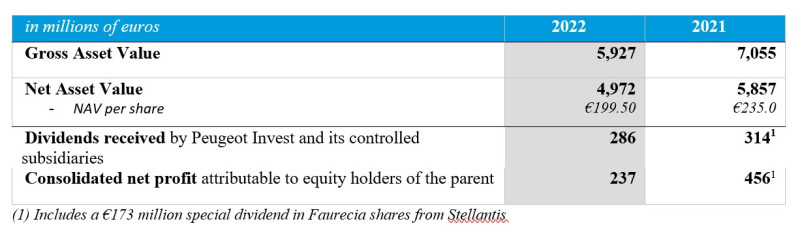

At 31 December 2022, Gross Asset Value (GAV) stood at €5.9 billion, with Net Asset Value (NAV) of €5.0 billion. NAV per share was €199.50, compared with €235.0 at 31 December 2021, representing an annual return of -14.0%, dividend included.

CONSOLIDATED NET PROFIT AND PROPOSED DIVIDEND WITH RESPECT TO 2022

Dividends received from investee companies totalled €286 million in the consolidated financial statements, a significant increase from the €141 million received in 2021, not including the €173 million special dividend paid by Stellantis in the form of Faurecia shares in the first half of 2021. This development was driven by the success of Stellantis and the sharp increase in its dividend payment.

Consolidated net profit attributable to equity holders of the parent was €237 million in 2022, representing a decline relative to the 2021 financial year, which incorporated the aforementioned special dividend.

Based on the strong resilience of business activities in 2022, the Board of Directors will propose a dividend of €2.85 per share at the 12 May 2023 Annual General Meeting, an increase of 7.5% relative to 2021.

REDUCTION IN NET DEBT

At 31 December 2022, Peugeot Invest had net debt of €885 million, a reduction of €261 million relative to 31 December 2021. This put the Loan-to-Value ratio (LTV) at 16%, slightly below LTV in 2021 (17%), despite the drop in Gross Asset Value.

Undrawn credit facilities at 31 December 2022 totalled €847 million, and the Group had no significant amounts due before 2025.

DYNAMIC ASSET MANAGEMENT IN 2022, RELEASING VALUE THROUGH ARBITRAGE

In 2022, Peugeot Invest sold €532 million in assets, releasing value of around €90 million during the financial year.

These disposals primarily involved two investees, including the remaining stake in Safran (€43 million) and the sale of bulk carriers held in partnership with Louis Dreyfus Armateurs (€21 million received in 2022 and the balance due in the first half of 2023, with a net return of 1.9x the initial investment). These disposals also concerned several co-investments, such as the sale of shares in Keurig Dr Pepper ($168 million, 1.8x), Bomi (€78 million, 3.8x), Asmodée (€46 million, 2.6x), Phaidon (€25 million, 5.7x), and EDH (€13 million, 5.0x).

Investments stood at €329 million and reflected selective management in a fast-changing macroeconomic environment.

Peugeot Invest helped to boost the balance sheet of several investee companies through capital increases, including €17 million in Forvia for the acquisition of Hella, €10 million in Signa Development Selection and €10 million in Signa Prime Selection, a prime real-estate firm.

The company committed to a number of new co-investments totalling around €50 million, notably in healthcare in Germany with Schwind, the European leader in ophthalmic lasers, SantéVet, a leading pet insurance company in France, and in the Indian market with LivSpace, a leading digital platform for interiors, and Country Delight, a subscription-based milk delivery platform. Peugeot Invest also strengthened its partnerships with ArchiMed and JAB, committing €100 million and $100 million to their new funds for healthcare and pet insurance, respectively.

In 2022, Peugeot Invest also committed €200 million to 14 private equity funds, evenly distributed between Europe (38%), the United States (41%) and emerging countries (21%), along with a €20 million investment in European real-estate fund Tikehau Real Estate Opportunity II.

BALANCED, DIVERSIFIED AND RESILIENT ASSETS IN LINE WITH LONG-TERM TRENDS

At 31 December 2022, Peugeot Invest's Gross Asset Value (GAV) was €5.9 billion, split between Peugeot 1810 (40%) and a diversified portfolio of Investments (60%).

Peugeot 1810: Peugeot Invest's historic asset, focusing on the future of mobility

Peugeot 1810 is one of the main shareholders (7.0%) in automotive group Stellantis, created through the merger between PSA Group and Fiat Chrysler Automobiles.

Peugeot 1810 is also a shareholder in FORVIA, the world's seventh-largest automotive supplier, with a stake of 3.1%.

The 76.5% holding in Peugeot 1810 was valued at €2.3 billion at 31 December 2022, down from €3 billion at 31 December 2021, as a result of the decline in Stellantis and Forvia share prices.

2022 highlights

Stellantis achieved record results in 2022 while forging ahead with its Dare Forward 2030 strategic plan and its electrification programme in Europe and the United States. Operating profit totalled €23 billion, an increase of 29% relative to 2021, with an operating margin of 13%, compared with 11.8% in 2021. Free cash flow amounted to €10.8 billion, with a net cash position of €26 billion.

In January 2022, Faurecia completed its acquisition of Hella, making it the world's seventh-largest automotive supplier, under the name FORVIA. The Group faced a number of challenges in 2022 (ongoing semiconductor shortages, supply-chain problems, soaring energy prices, withdrawal from Russia) and achieved an operating margin of 4.4% (including 5% in the first six months of the year) while completing refinancing for the Hella acquisition.

Diversified global Investments supported by long-term structural trends

At 31 December 2022, the value of Investments amounted to €3.6 billion, compared with €4.0 billion at 31 December 2021. For the financial year, the Gross Asset Value of Investments fell by 10.3% in line with European market changes, with a relatively even performance (not including Orpea), reflecting real resilience.

The Gross Asset Value of Investments was split between three types of investment that complemented one another in their approach and their method of ownership. Overall, these Investments focused on strong companies operating in growth markets or addressing structural growth trends: the climate and energy transition; the digitalisation of the economy; the growing demand in healthcare and domestic services; greater outsourcing of business services; and the development of middle classes around the world.

• Direct holdings in listed and unlisted companies: this portfolio represented €1.7 billion, or 29% of total GAV. It consists of equity stakes in 17 companies (of which seven are listed) for investments ranging from €50 million to €250 million, in which Peugeot Invest is one of the main shareholders and has a representative on the board.

• Co-investments: This portfolio amounted to €951 million, or 16% of Gross Asset Value. These investments consist of 45 companies in which Peugeot Invest has made equity investments starting at €10 million, alongside investment funds or partners. This approach allows Peugeot Invest to diversify its investment strategies in regions and sectors in which partners can offer significant additional expertise.

• Investment funds: This portfolio amounted to €839 million, or 14% of Gross Asset Value. Peugeot Invest has commitments to investment funds in both private equity (LBO/Growth) and real estate in the United States, Europe, Asia and emerging markets, with commitments ranging from €10 million to €25 million per fund.

2022 highlights

Investments reflected contrasting performance, with business models holding up well against growing inflation, higher energy prices and rising interest rates. SPIE saw acceleration in organic growth (+6.9%) and an improvement in its operating margin, while International SOS experienced ongoing growth as a result of Covid and government contracts. LISI slightly improved its operating margin in a still-volatile environment. Tikehau Capital topped €35 billion assets under management, while Signa Prime, with its focus on city-centre prime real estate, was able to pass on the cost of inflation through leases, allowing it to effectively withstand rates hike. However, after a record year, the SEB Group was hit by the slowdown in household purchases of electrical appliances and a sharp increase in costs. Private equity funds, selected for their operational support and financial discipline, continued to deliver performance. The high share of unlisted assets has limited the volatility of valuations and the disposals carried out have generated additional value creation. The Gross Asset Value of Investments was particularly affected by the collapse in the price of ORPEA shares following a serious internal crisis that led to an overhaul of the company's management team, doubts over its business development model, and financial structuring. In the first quarter of 2023, an agreement was reached with banks, a group representative of the unsecured creditors and La Caisse des Dépôts in conjunction with CNP, MAIF and MACSF which should allow a large balance sheet restructuring to secure the future of the company.

ESG POLICY AN INTEGRAL PART OF PEUGEOT INVEST PRACTICES

Peugeot Invest launched its ESG initiative in 2016 with a focus on both internal practices and support for investee companies. Governance has been a focal point for Peugeot Invest from the outset and goes hand in hand with special attention to issues related to the climate transition. In 2022, Peugeot Invest continued the ESG maturity analysis of its assets, covering 80% of the Gross Asset Value at 31 December 2022, and pursued dialogue with investees on the main material issues for each shareholding. Peugeot Invest also hired an Sustainability manager and set up a Sustainable Development Committee as part of its Board of Directors.

CHANGES IN GOVERNANCE

At the General Meeting of 12 May 2022, shareholders approved the resolutions concerning changes to the Board of Directors.

Four new directors were appointed: one independent director, Béatrice Dumurgier, two Peugeot family members, Camille Roncoroni and Rodolphe Peugeot, and Etablissements Peugeot Frères, represented by its Chief Executive Officer, Thierry Mabille de Poncheville. They replaced four outgoing directors and family members: Marie-Hélène Peugeot-Roncoroni, Christian Peugeot, Jean-Philippe Peugeot and Xavier Peugeot, all of whom Robert Peugeot thanked for their commitment and contribution. Michel Giannuzzi, Chairman of Verallia, also joined the Board in November.

The Board is now composed of 57% female directors, 36% independent directors and 50% directors who are members of the Peugeot family.

Following the creation of the Sustainable Development Committee, the Peugeot Invest Board of Directors now has four permanent committees: the Governance, Appointments and Remuneration Committee; the Investments and Shareholdings Committee; the Finance and Audit Committee; and the aforementioned Sustainable Development Committee.

POST-BALANCE SHEET EVENTS

On 13 February 2023, Peugeot Invest announced it had teamed up with Concordia for the proposed simplified tender offer for Rothschild & Co shares. In the case of a successful offer, Peugeot Invest could hold up to 5.1% of Rothschild & Co's capital and would be represented on the company's Supervisory Board.

On 16 February 2023, Peugeot Invest announced the sale of its stake in Tikehau Capital Advisors (TCA) to its management. Peugeot Invest supported TCA growth for seven years as a leading alternative asset manager and will continue to partner Tikehau Capital through co-investments and as an investor in some of its funds.

On 23 February 2023, Peugeot Invest announced that it would take part in the reorganisation of the ownership structure of LISI. Peugeot Invest has been supporting the development of LISI for more than 40 years and will continue to support the company as a significant shareholder and member of the LISI Board of Directors.

On 20 March 2023, Peugeot Invest completed the final sale of "Les Grésillons" warehouse facility in Gennevilliers, for €38 million.

OUTLOOK

The start of 2023 continues to see significant ongoing geopolitical and macroeconomic uncertainty. Peugeot Invest teams remain highly attentive to developments affecting Peugeot Invest assets and are intent on continuing to prioritise companies with resilient business models who are leaders in their market and buoyed by long-term structural trends.

Several investees announced increased dividends in 2022. Peugeot Invest will receive these dividends in 2023, which will boost its liquidity and give it the means to successfully pursue its long-term value creation and investment policy.